Data Breaches

Data breaches are a form of identity theft. With your personal information in hand, identity thieves can open credit accounts in your name and quickly incur substantial charges for which you may be held financially responsible. Often, the account statements are directed to an address other than the consumer to avoid detection. The savvy consumer will regularly check their credit reports to assess whether a creditor is attempting to hold them responsible for accounts which they did not open.

Were you a victim of a data breach? If so, check your credit reports as one method to detect whether your information was used to open credit accounts. Visit annualcreditreport.com for free credit reports or purchase them directly from each bureau’s website (Equifax.com Experian.com TransUnion.com Innovis.com)

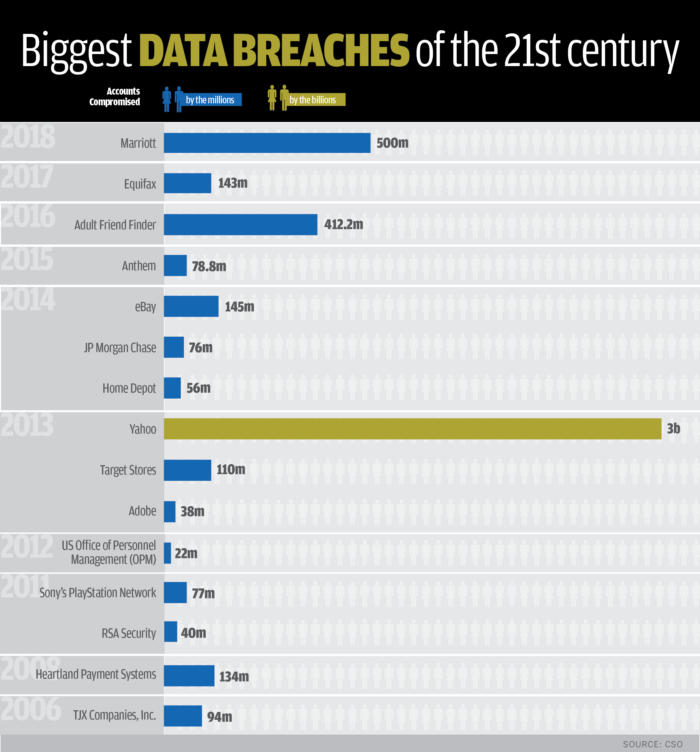

Note the magnitude of impact on literally hundreds of millions of people:

What to do if you suspect you are the victim of a Data Breech

The firm encourages consumers to follow these steps:

- check your credit reports now — an ID thief may have stolen your information already and used it to access credit in your name

- free reports are available at annualcreditreport.com

- if your reports do not show any unfamiliar accounts, continue to check your credit reports on a regular basis

- if you do find unfamiliar accounts on your report, contact us immediately

our firm can guide you through the dispute process- when that process fails, we represent consumers on a contingency basis to obtain a permanently corrected report and compensation.