Equifax’s former CEO is testifying before Congress this week. In spite of the potential for great harm to consumers, industry-insiders expect little regulatory change in the wake of Equifax’s breach. The fact that credit is such an integral piece of the economy, generally—and the degree to which the economy relies upon a functioning credit reporting […]

In the wake of Equifax’s breach, the credit agency hired Mandiant to conduct a review. Mandiant’s review concluded that an additional 2.5 million consumers were subject to the breach, bringing the total to 145.5 million. “Equifax said it will mail notices to all potentially impacted individuals that have been identified since the Sept. 7 announcement.” […]

Dominick Tavella, of Diversified Financial Consultants, suggests that consumers sign up for credit alerts in order to protect against unwarranted issuances of credit, resulting from the Equifax breach. Tavella cautions consumers about Equifax’s offer to provide credit monitoring free for a year, as the information gained through the data breach may not be used (or […]

It was déjà vu for Wells Fargo, this week, as senators expressed outrage at the bank’s culture of shady practices. Last year, senators berated (former-CEO) John Stumpf over the millions of fake accounts created in customers’ names. Stumpf’s replacement, Tim Sloan, took the brunt of congressional ire on Tuesday, with Senator Brian Schatz of Hawaii […]

The Big Three credit agencies are juggling roughly 2.6 billion data entries apiece, at any given time. With over 1 billion modifications to those entries each month, “[s]peed and volume are favored over accuracy.” Aaron Klein of the Brookings Institute writes, the “costs of correcting the data outweigh benefits,” leading to millions of errors on […]

Until recently, mortgage lenders could access the lien and judgment history of potential borrowers through a borrower’s credit report. The national credit reporting agencies (NCRAs), TransUnion, Equifax, and Experian, did such a poor job of keeping reliable records on liens and judgments—Social Security numbers were missing from roughly 50% of tax lien records and 96% […]

Richard Smith, the beleaguered CEO of Equifax, has stepped down from his post. Apart from referring to Smith’s exit as a “retirement,” Equifax makes no effort to conceal the reasons for his departure. Since Equifax’s data breach was made public earlier this month, “[a]s much as one-third of Equifax’s market value [has] vanished;” the corporation […]

Clear partisan lines emerge in response to the Equifax breach. Last week, Democrats introduced the Freedom from Equifax Exploitation Act, barring credit bureaus the ability to charge a fee for freezing consumer credit. House Republicans, on the other hand, propose to undermine credit-industry regulations with new legislation. The Credit Services Protection Act, introduced by Ed […]

NY Governor, Andrew Cuomo, announces new regulations for credit reporting agencies. Referring to July’s Equifax breach as “a wake-up call,” Cuomo said that NY will hold the credit industry to the same scrutiny as banks and other financial industries who do business in the state. Credit reporting agencies will be required to register with the […]

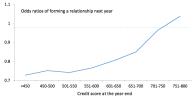

While it may not surprise you that having good credit contributes to one’s general attractiveness, recent data suggests that relationship seekers prioritize high credit scores to a surprising degree over more traditional markers of attractiveness, such as having a nice car or holding a high-status career. Match.com’s Chief Scientific Advisor, Helen Fisher, suggests that we […]