Credit scores for decades have been based mostly on borrowers’ payment histories. That is about to change. https://www.wsj.com/articles/want-a-higher-credit-score-soon-your-cash-could-help-1540123200?mod=djemwhatsnews

Category Archives: Credit Scores

The new law has a long name – Economic Growth, Regulatory Relief, and Consumer Protection Act – but the outcome is simple. When the law takes effect in September, Equifax, Experian and TransUnionmust each set up a webpage for requesting fraud alerts and credit freezes. The FTC will also post links to those webpages […]

http://money.cnn.com/2018/05/22/pf/free-credit-freeze/index.html The new legislation will make placing, lifting, and permanently removing freezes free no matter where you live. It also requires consumer rating companies to fulfill your request within one business day if made online or over the phone, and within three business days if requested by mail. The changes will take effect about […]

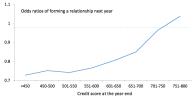

While it may not surprise you that having good credit contributes to one’s general attractiveness, recent data suggests that relationship seekers prioritize high credit scores to a surprising degree over more traditional markers of attractiveness, such as having a nice car or holding a high-status career. Match.com’s Chief Scientific Advisor, Helen Fisher, suggests that we […]

Criminal background checks are commonplace Applications for certain employment positions. But what about credit checks? Is a job applicant’s credit history relevant for employment? May an employer lawfully check a job applicant’s credit? State and local laws are becoming more restrictive, adding an extra layer of protection for consumers over and above the federal […]

Tens of thousands of people who took out private loans to pay for college but have not been able to keep up payments may get their debts wiped away because critical paperwork is missing. The troubled loans, which total at least $5 billion, are at the center of a protracted legal dispute between the student […]

This is part four of a four-part series that looks at how inaccurate credit reporting is being fought by attorneys, the CFPB, and state AGs. CFPB Nails Credit Repair Doctors: The credit bureaus not only make mistakes, they fail to conduct adequate reinvestigations of disputes or remove inaccurate information. Instead of complying with these FCRA […]

About 12 million people will get a lift in their credit scores next month as the national credit reporting agencies wipe from their records two major sources of negative information about borrowers: tax liens and civil judgments. The change stems from a lengthy crusade by consumer advocates and government officials to force the credit bureaus […]

As the CRCs roll out improvements under NCAP [National Consumer Assistance Plan], tax lien and public records data that historically was used to calculate consumers’ credit scores likely will be eliminated entirely or in part. With those changes in mind, VantageScore 4.0: – Distinguishes medical collections from other types of collection accounts, ignores medical collections less than […]